Mortgage rate forecast for next week (Sept. 26-30)

Mortgage rates grew for the fourth week in a row and broke 6% for the first time since 2008.

The average 30-year fixed interest rate rose from 5.89% on Sept. 8 to 6.02% on Sept. 15, according to Freddie Mac.

With another week of growth, the lending market continues to make adjustments for the large Federal Reserve hike likely coming at the end of the month. The Fed keeps signaling aggressive policy actions in order to bring inflation down to normal levels.

Will mortgage rates go down in September?

Mortgage rates fluctuated greatly so far in the third quarter of 2022, with the average 30-year fixed rate dipping as low as 4.99% on Aug. 4 to a high-water mark of 6.02% on Sept. 15, according to Freddie Mac.

This followed 248 basis points (2.48%) of growth in the year’s first half. Rates varied from one week to the next as the Fed wrestled with inflation. Mortgage rates experienced the largest weekly jump since 1987, surging 55 basis points (0.55%) the day after the Federal Reserve’s June hike.

With the pandemic’s declining economic impact, decades-high inflation, and the Fed planning three more aggressive hikes, interest rates could continue trending upward this year.

However, concerns over an impending recession have caused rate drops and could cause more on any given week.

Experts from Attom Data Solutions, CoreLogic, Realtor.com and other industry leaders are split on whether 30-year mortgage rates will keep climbing in September or level off.

“If fears of recession outweigh fears of inflation, mortgage rates may come down.”

–Odeta Kushi, deputy chief economist at First American

Expert mortgage rate predictions for September

Paul Buege, chief executive officer and president at Inlanta Mortgage

Prediction: Rates will rise

“I think we’re going to be range-bound and we’ll see rates stay at this level, maybe a little bit higher. The market is responding to the Fed’s two significant rate increases and the economy is cooling. What you’re seeing right now is the initial response: a recession and people aren’t buying as much.

But always lurking in the background is going to be some economic news showing that things haven’t cooled to the level that you might think. That’s why I think you’re gonna have these little rate bumps up and down. If you wanted to work with a really broad range, probably 6% would be the high and 5% might be the low. That’s what we’re using as we manage our book of business as a company.”

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

“There isn’t a Fed meeting [in August] but there is the annual economic policy symposium in Jackson Hole that a lot of the Fed decision makers participate in. Investors will look to that symposium to get an updated sense of how the Fed is thinking about monetary policy and we may see mortgage rates react to whatever is discussed.

Even though the Fed is still tightening policy, inflation is moving back in the direction that we want to see. I think that means we’re going to see a bit more volatility in mortgage rates in the next year. The fact they’ve come down from 5.8% suggests that investors believe the Fed may not have to increase short-term rates as high as they thought two months ago. Watching those inflation numbers is key to getting an idea of where mortgage rates might go moving forward.”

Selma Hepp, deputy chief economist at Corelogic

Prediction: Rates will moderate

“Mortgage rates will likely remain around 5.5% in September. While the highly-anticipated Fed meeting will take place in September, the mortgage market has likely already accounted for all of the expected increase in the funds rate in 2022 prior to the June meeting, when mortgage rates jumped to 6%. The decrease in rates since then reflects the adjustment to slowing home buying demand and widening economic uncertainty.

Borrowers should be in a better position to get a more favorable rate than in June. Also, borrowers have increasingly turned to adjustable-rate mortgages which provide some relief with monthly mortgage expenditures. Borrowers in a position to do so could help lower their rates by coming up with larger down payments.”

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

“Ongoing concerns about the economy and the Federal Reserve’s fight against inflation may prompt mortgage rates to follow a seesaw trend in September. While some agree that inflation may have peaked, it remains uncomfortably high, which puts the Fed in a position to continue interest rate hikes.

Going forward, if fears of recession outweigh fears of inflation, mortgage rates may come down. However, if inflation surprises to the upside, the Fed will likely take more aggressive action and mortgage rates will climb faster as a result. Ultimately, how the market interprets incoming data leading up to the September Federal Open Market Committee (FOMC) meeting will have a strong impact on how mortgage rates respond in September.”

Jessica Lautz, VP of demographics and behavioral insights at National Association of Realtors

Prediction: Rates will moderate

“There seems to currently be some leveling off of the recent rise in mortgage interest rates. Inflation plays the key role in what happens next, but it’s possible we are at a plateau for mortgage interest rates.

Consumers should talk to a few mortgage brokers. Different brokers may be familiar with home loan products that help buyers with their first home loan.”

Rick Sharga, EVP of market intelligence at Attom Data Solutions

Prediction: Rates will moderate

“It appears that the market has already “baked in” rate hikes from the Federal Reserve — that may have something to do with the sudden jump in rates even before we saw the Fed dramatically raise Fed Funds rates.

I don’t expect September mortgage rates to behave much differently than what we’re seeing right now — we’ll probably continue to see rates on 30-year fixed-rate loans ranging between 5% and 5.50% over the course of the month, unless we get any unexpectedly negative economic news.

Another thing to consider is home sales have dropped significantly as mortgage rates have risen — 15% in June, which marked the sixth consecutive month of decreasing sales. We may be seeing some rate competition among lenders in an attempt to make home purchases slightly more affordable for buyers and to generate more purchase loan activity. While lenders certainly can’t control interest rates, they can nibble at the margins, perhaps sacrificing some profit in order to secure more volume.”

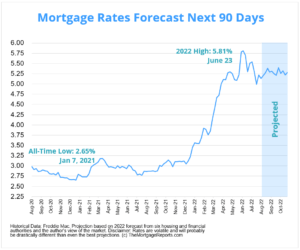

Mortgage interest rates forecast next 90 days

The Federal Reserve made an aggressive policy plan to bring inflation down. While that would normally lead to mortgage rate growth, the lending market may have already accounted for the Fed’s rate hikes.

Because of this, many experts currently believe mortgage interest rates will move within a tighter range in the fall compared to the big weekly swings we saw throughout the year.

Of course, the Russian-Ukrainian war or a new wave of Covid-19 could create economic uncertainty and cause more rate volatility in the coming months.

Mortgage rate predictions for 2022

The average 30-year fixed-rate mortgage ended the second quarter of 2022 at 5.7%, according to Freddie Mac.

Five of the six major housing authorities we gathered project the average for the third quarter to drop below that.

Fannie Mae and the National Association of Home Builders sit at the low end of the group, estimating the average 30-year fixed interest rate will settle below 5.2% by the end of Q3. Meanwhile, Freddie Mac and the National Association of Realtors had the highest predictions, with forecasts of 5.5% and 5.8%, respectively, by the end of September.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q3 2022) |

| Fannie Mae | 5.10% |

| National Association of Home Builders | 5.19% |

| Mortgage Bankers Association | 5.20% |

| Wells Fargo | 5.20% |

| Freddie Mac | 5.50% |

| National Association of Realtors | 5.80% |

| Average Prediction | 5.33% |

Current mortgage interest rate trends

With the September Fed meeting approaching and another big hike expected, average mortgage rates climbed for the fourth week in a row.

The average 30-year fixed rate shot up from 5.89% to 6.02% for the seven days ending Sept. 15, according to Freddie Mac’s weekly rate survey.

Similarly, the 15-year fixed rate rose from 5.16% to 5.21%, and the average rate for a 5/1 ARM jumped from 4.64% to 4.93%.

| Month | Average 30-Year Fixed Rate |

| August 2021 | 2.84% |

| September 2021 | 2.90% |

| October 2021 | 3.07% |

| November 2021 | 3.07% |

| December 2021 | 3.10% |

| January 2022 | 3.45% |

| February 2022 | 3.76% |

| March 2022 | 4.17% |

| April 2022 | 4.98% |

| May 2022 | 5.23% |

| June 2022 | 5.52% |

| July 2022 | 5.41% |

Source: Freddie Mac

Mortgage rates moved on from the record–low territory seen in 2020 and 2021 but are still below average from a historical perspective.

Dating back to April 1971, the fixed 30–year interest rate averaged around 7.8%, according to Freddie Mac. So if you haven’t locked a rate yet, don’t lose too much sleep over it. You can still get a great deal, historically speaking — especially if you’re a borrower with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

| July 2022 | June 2022 | May 2022 | |

| Conforming Loan Rates | 5.30% | 5.79% | 5.34% |

| FHA Loan Rates | 5.27% | 5.59% | 5.25% |

| VA Loan Rates | 5.00% | 5.34% | 4.95% |

| Jumbo Loan Rates | 5.02% | 5.34% | 4.92% |

Source: Black Knight Originations Market Monitor Report

Which mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high–priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $647,200 in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice. VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low–down–payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620. FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less–than–perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA–eligible.

Mortgage rate strategies for September 2022

Mortgage rates grew fast and furiously to open in 2022. The pace slowed in the second quarter, then interest rates shot up after the Fed’s 0.75% federal funds rate hike in mid-June. The central bank said it anticipates multiple similar hikes in 2022. Mortgage rates could climb throughout the rest of the year as a means to offset inflation. However, opportunities to lock in a low-interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the coming months.

Have a plan — and stick to it

“Don’t doom scroll, don’t get too seduced by the headlines. It can be tough for the first-time home buyer, but it also doesn’t have to be if you have a plan.”

-Paul Buege, chief executive officer and president at Inlanta Mortgage

Between ballooning prices and a lack of listings, home buying in 2022 has been tough and likely even frustrating for many borrowers. However, conditions are beginning to ease.

With listings sitting on the market longer and interest rates possibly peaked, now’s not the time to give up or be erratic with your money. Much like playing at a blackjack table, your best bet at winning — or in this case, buying a home — comes with sticking to a consistent strategy and patience.

“Don’t doom scroll, don’t get too seduced by the headlines. It can be tough for the first-time home buyer, but it also doesn’t have to be if you have a plan,” Buege said. “If someone wants to buy a home, you can, it just might be at a different time than what you’re hoping. But I think things are cooling down. We really try to advise everyone to respect the market. Virtually everything that’s going on out there is outside all of our control.”

So figure out when you want to buy a home, prepare yourself, and know all the borrower requirements. While affordability took a hit over the last few years, you can still get creative and find ways to save money.

Work for a lower interest rate

One of the biggest parts of home buying is the mortgage rate you’re able to lock into. Everyone wants the lowest possible interest rate they can get but that’s mostly determined by what the lending market offers on a given day. Unfortunately, timing isn’t always in every borrower’s favor.

That’s where mortgage discount points come in. It’s a lever borrowers can pull to decrease their monthly mortgage costs and paying down your rate could save thousands of dollars over the life of your home loan.

“Rather than asking the seller to drop their price, a buyer can leverage a seller concession to buy down their mortgage rate via points,” said Taylor Marr, deputy chief economist at Redfin. “This will have a much greater impact on lowering their monthly mortgage payment than a lower [home purchase] price would.”

Although, paying for mortgage points adds more upfront costs at closing, which could be a barrier to entry for some borrowers. Shopping your rate around by contacting multiple lenders to see if they can offer a lower one only requires time and effort. Given how lenders differ and how volatile interest rates tend to be, taking your first offer could be a mistake.

How to shop for interest rates

Rate shopping doesn’t just mean looking at the lowest rates advertised online because those aren’t available to everyone. Typically, those are offered to borrowers with perfect credit and who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Mortgage interest rate FAQ

Current mortgage rates are averaging 6.02% for a 30–year fixed–rate loan, 5.21% for a 15–year fixed–rate loan, and 4.93% for a 5/1 adjustable–rate mortgage, according to Freddie Mac’s latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Mortgage rates could decrease next week (Sept. 26-30, 2022) if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders continue to account for the Federal Reserve taking more aggressive measures to counteract the high inflation of 2022.

It’s unlikely mortgage rates will go down in 2022. Inflation has been climbing at a record rate over the last few months. And the Fed is planning to raise interest rates after each of its scheduled FOMC meetings. Both these factors should lead to significantly higher mortgage rates in 2022.

Yes, it’s very likely mortgage rates will increase in 2022. High inflation, a strong housing market, and policy changes by the Federal Reserve should all push rates higher in 2022. The only thing likely to push rates down would be a major resurgence in serious Covid cases and further economic shutdowns. But, while it could help mortgage rates, no one is hoping for that outcome.

Freddie Mac is now citing average 30-year rates in the 5 percent range. If you can find a rate in the 4s, you’re in a very good position. Remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below-average interest rates, while poor-credit borrowers and those with non-QM loans could see much higher rates. You’ll need to get pre-approved for a mortgage to know your exact rate.

For the most part, industry experts do not expect the housing market to crash in 2022. Yes, home prices are over-inflated. But many of the risk factors that led to the 2008 crash are not present in today’s market. Low inventory and massive buyer demand should keep the market propped up next year. Plus, mortgage lending practices are much safer than they used to be. That means there’s not a subprime mortgage crisis waiting in the wings.

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65 percent. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely used benchmark for current mortgage interest rates.

Locking your rate is a personal decision. You should do what’s right for your situation rather than trying to time the market. If you’re buying a home, the right time to lock a rate is after you’ve secured a purchase agreement and shopped for your best mortgage deal. If you’re refinancing, you should make sure you compare offers from at least three to five lenders before locking a rate. That said, rates are rising. So the sooner you can lock in today’s market, the better.

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

Start by choosing a list of three to five mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (Loan Estimates) to find the best overall deal for the loan type you want.

What are today’s mortgage rates?

Mortgage rates are rising, but borrowers can usually find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.